Depreciation days calculation

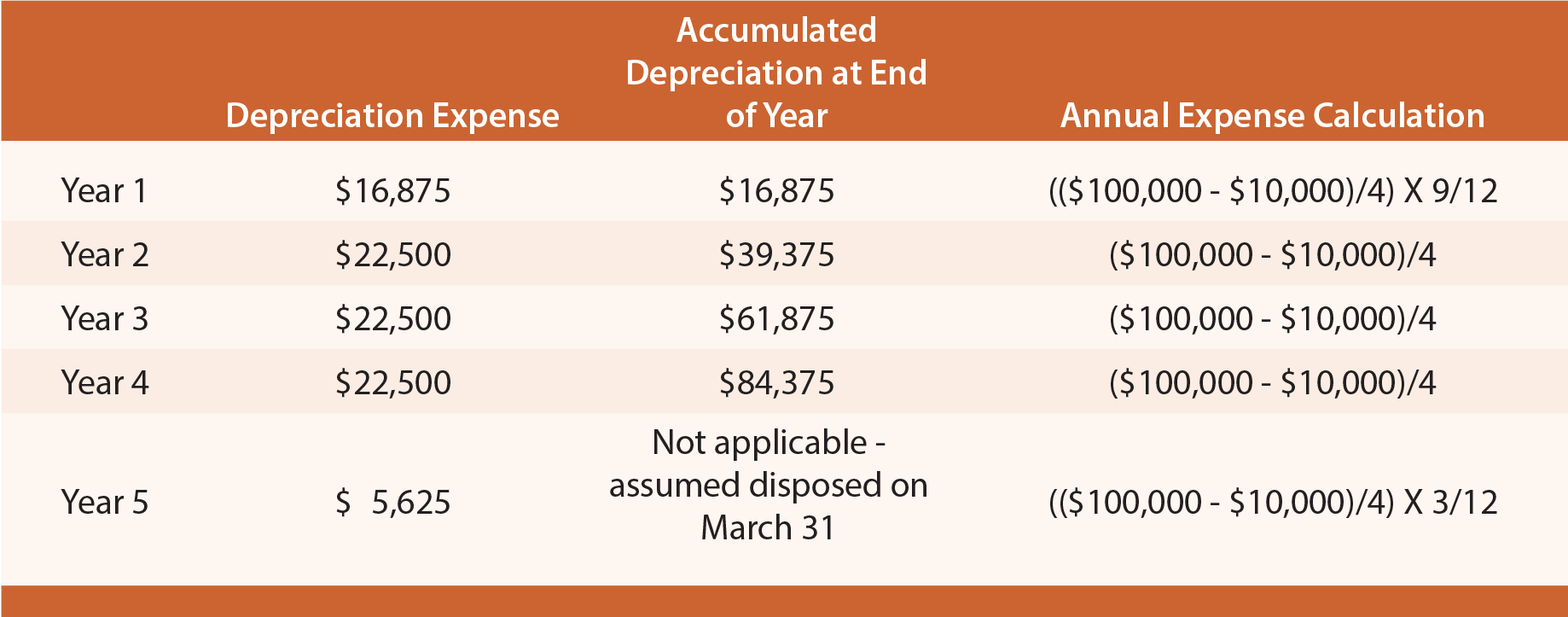

If asset is put to use for less than 180 days then amount equal to 50 of the amount calculated using normal depreciating rates is allowed as depreciation. First one can choose the straight line.

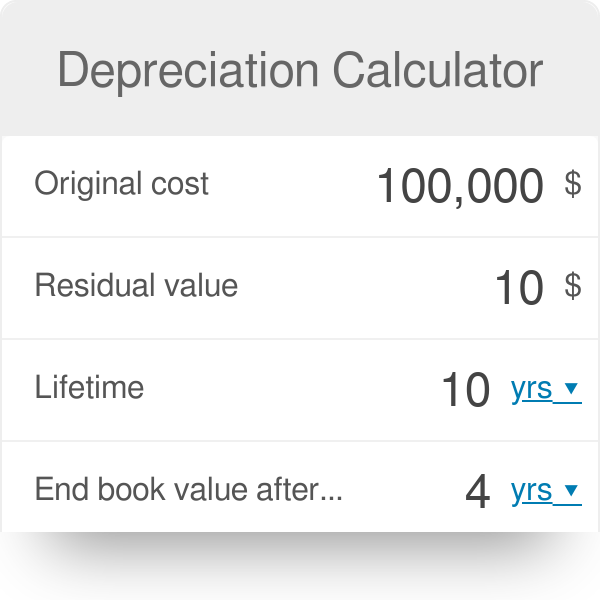

Declining Balance Depreciation Calculator

This depreciation calculator is for calculating the depreciation schedule of an asset.

. From financial year 2015. FA Depreciation Calculation with FA Block and Additional Depreciation FA Block. Excel has the DB function to calculate the depreciation of an asset on the fixed-declining balance basis for a specified period.

After three years it might only be worth 1500. Ie Asset put to use on or before. Also includes a specialized real estate property calculator.

Depreciation is calculated as a percentage of book value based on. However if the asset is put to use for less than 180 days then additional deprecation will be allowed at half of actual rate ie 10 or 175 as the case may be. 22 Diminishing balance or Written down.

Perhaps you can only sell it for 4000 after a year. The Depreciation Starting Date field is used to calculate the number. 2 Methods of Depreciation and How to Calculate Depreciation.

Managers Depreciation Calculation Worksheet currently calculates depreciation using the declining balance method. It provides a couple different methods of depreciation. The function needs the initial and salvage costs.

Depreciation is allowed on block of assets. This simple depreciation calculator helps in calculating depreciation of an asset over a specified. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method.

Depreciation days calculation Senin 05 September 2022 Edit. No of days from 20 sept to 31 March is more than 180 Hence full depreciation at 10 Dep on Furniture 50000010 50000 Q2 Furniture Purchased for 500000 on 20. Block of assets is a group of assets falling.

This ensures that the program will start using the specified percentage on the same day for all assets. Remaining depreciation days are calculated as the number of depreciation days minus the number of days between the depreciation starting date and the last fixed asset. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

This gradual reduction in value is called depreciation.

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Calculator Definition Formula

How To Calculate Depreciation Expense For Business

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Calculate Depreciation Expense

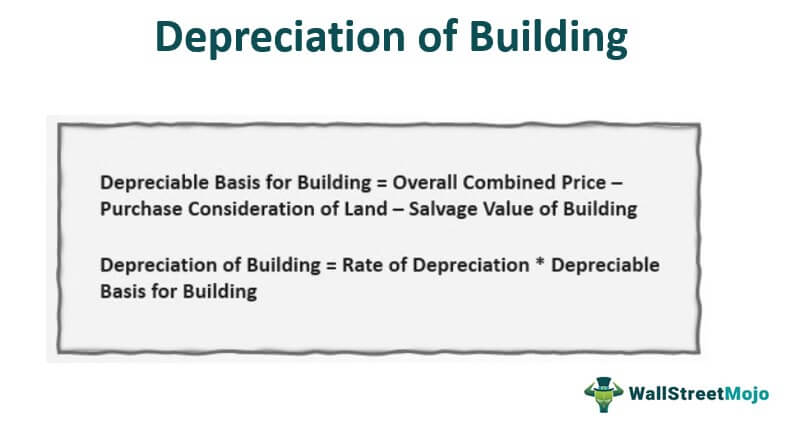

Depreciation Of Building Definition Examples How To Calculate

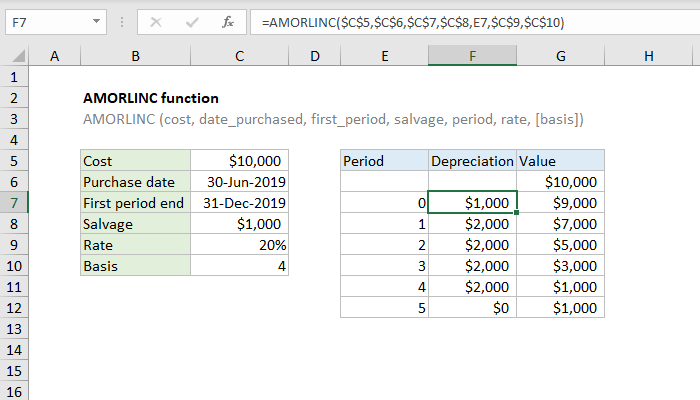

How To Use The Excel Amorlinc Function Exceljet

Financial Accounting Depreciation Calculation Fixed Assets Codecademy Fixed Asset Financial Accounting Udemy Coupon

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Schedule Formula And Calculator Excel Template

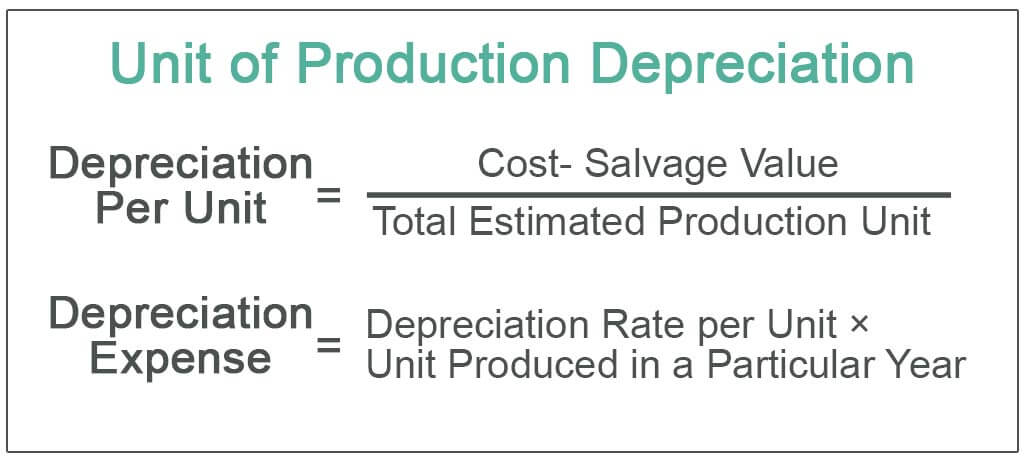

Unit Of Production Depreciation Method Formula Examples

How To Use The Excel Db Function Exceljet

How To Calculate Depreciation Youtube

Depreciation Schedule Formula And Calculator Excel Template